Valuation

& Advisory

Overview

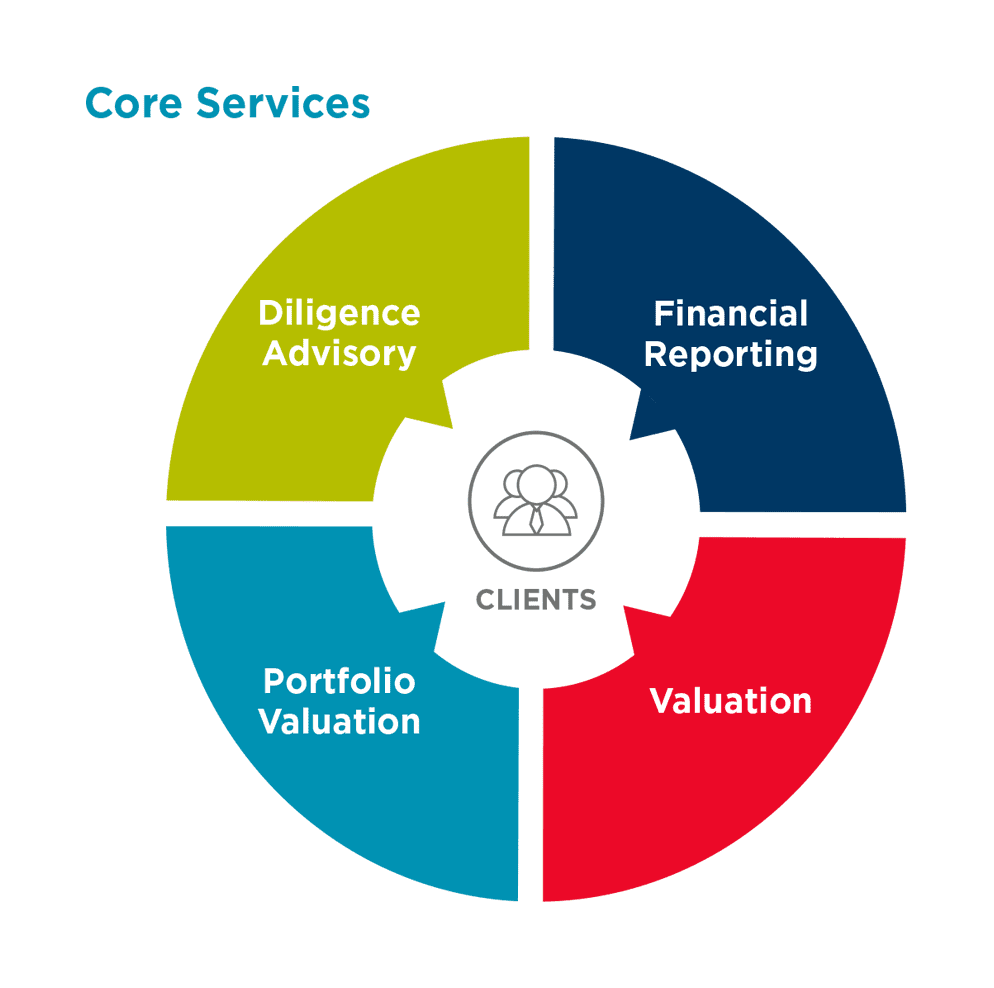

Our Valuation & Advisory group guarantees you’ll have access to trustworthy data, swift reporting and best-in-class-service and insights.

Our capabilities include diligence advisory, financial reporting, portfolio valuation, and individual valuation. With 15 practice groups, we deliver real estate strategies and solutions to clients with unique operational, technical, and business requirements. Access to real-time market data, the insights of our leasing teams, research and capital markets experts, and the experience derived from 30 years of operation ensure the application of best practices and proven successful methodologies.

The Cushman & Wakefield Advantage:

- Consistent delivery across multi-market client portfolios

- Timely delivery of value conclusions

- Compliance with financial regulatory requirements

- Valuations based on access to constantly updated market data

Diligence Advisory

The Diligence Advisory Group specializes in acquisition due diligence, underwriting for debt and equity investments, internal credit/risk management analysis, strategic bank advisory, and an array of services specifically designed to meet the investment strategies of our clients. Our projects encompass underwriting and transaction management for CRE participants across the spectrum and up and down the capital stack. Our seasoned professionals leverage the larger Cushman & Wakefield knowledge capital when advising clients on complex debt and equity investment decisions and, with access to real time market data and global insights, our DAG professionals are equipped with boots-on-the-ground knowledge allowing us to identify emerging trends and surface potential risks for lenders and investors.

Financial Reporting

With exceptional credentials, industry knowledge, and unparalleled talent, our professionals are uniquely qualified to address financial reporting and related issues on both a national and international basis. We provide services for financial reporting purposes, such as fair value, purchase price allocation, and fresh start accounting, which adhere to applicable standards including U.S. GAAP and IFRS, as well as country-specific compliance. We provide robust advice, C-level interaction and consulting, and peer-to-peer review.

Valuation/Portfolio Valuation

In today’s investment climate, it is crucial that investors, lenders, and occupiers understand the value of their assets. We specialize in providing appraisal services for corporations, institutional investors, advisors, and lenders on critical equity and debt investment decisions.

We have extensive experience with multi-property portfolios. Portfolio assignments are coordinated by our Portfolio Valuation team and backed by our proprietary web-based appraisal management platform. This platform acts as a “collaborative environment” where the client and our teams share information about each assignment, including a summary of our values, assumptions and conclusions, and electronic copies of each appraisal report.

Practice Groups

Automobile Dealership

The Automobile Dealership Practice Group is comprised of professionals with specialized training and experience in the valuation of automobile dealerships. The group is distinguished by its combination of industry experience, local market insight, geographic coverage and responsive service.

Data Centers

The Data Center Practice Group is one of the most experienced in the industry, seen as a trusted advisor to corporations, institutional investors and lenders as they make critical debt and equity investment decisions regarding their mission critical assets and properties.

Gas Station & Convenience Store

The Gas Station & Convenience Store Practice Group performs valuation and advisory services within this asset specialty, with a strong emphasis on going-concern valuation. Appraisals address the allocations of the major component parts of a property; such as land, building, site improvements, fuel equipment, store equipment and business enterprise.

Golf

Providing specialized skills and local market knowledge, our team has the experience to serve clients that require expert advice in golf properties. Our skilled group of dedicated real estate professionals has performed numerous assignments on individual golf properties and leading golf portfolios.

Government

Our Government Practice Group conducts valuation and consultation services relating to federal, state, local and tribal government entities. Our highly trained team is experienced with an array of asset types unique to government entities. Past assignments include national laboratory campuses, military properties and veterans’ administration campuses. Right of way assignments include total acquisitions as well as partial acquisitions.

Hospitality & Gaming

The Hospitality & Gaming Practice Group offers a full range of valuation, advisory, property tax and litigation support services. The team is distinguished by its combination of industry experience, local market knowledge, global coverage and responsive service.

Industrial

Industrial valuation is one of the core competencies of our Valuation & Advisory practice. Our appraisal professionals have extensive industrial property experience and are strategically located in the major markets.

Multifamily

The Multifamily Practice Group has a broad base of experienced professionals who are well versed in all forms of multifamily assets ranging from suburban, garden-style properties to urban high-rise complexes. The team is extensively involved with assets around the nation, with specialized expertise in affordable housing, age-restricted housing and student housing.

Office

The Office Practice Group has extensive experience with all types of office buildings. We draw from our proprietary in-house resources including a comprehensive database, dedicated research team and access to the top office leasing and investment sale brokers in the world.

Residential Development

Our Residential Development Practice Group actively works in residential development markets. We incorporate the most current and applicable data into our analyses, which assist our clients in making well-informed acquisition, disposition, financing, underwriting and investment decisions.

Restaurant

The Restaurant Practice Group performs valuation and advisory services within the restaurant industry. Appraisal services address the allocations of the major component parts of a property such as; land, building, site improvements, restaurant equipment and business enterprise.

Retail

The Retail Practice Group has resources across the globe to meet your valuation and advisory related needs. Group members have extensive valuation experience and are dedicated retail experts in their market areas. This depth of talent enables us to offer clients value-added advice involving their retail investment decisions.

Self Storage

Cushman & Wakefield’s Self Storage Industry Group (SSIG) is an international, full service, real estate appraisal team specializing in the self storage asset class. SSIG is known the world over as an industry knowledge leader. Through the delivery of timely, accurate, high-quality valuation and research reports, we aim to assist our clients in making property decisions that meet their objectives and enhance their decision making process.

Senior Housing/Healthcare

The Senior Housing/Healthcare Practice Group has extensive senior housing and healthcare experience and is strategically located in the major marketplaces. Combined, the team has completed in excess of 7,500 healthcare related valuation assignments over the past three years.

Sports & Entertainment

The Sports & Entertainment Group offers a full range of valuation and advisory services pertaining to a wide variety of property types within this sector. The serviceline combines acute industry expertise with global resources to provide valuation opinions and intuitive solutions for our clients. Our team is comprised of industry-leading professionals, each with constant and extensive exposure to investors, property owners, financial institutions, developers and public entities.